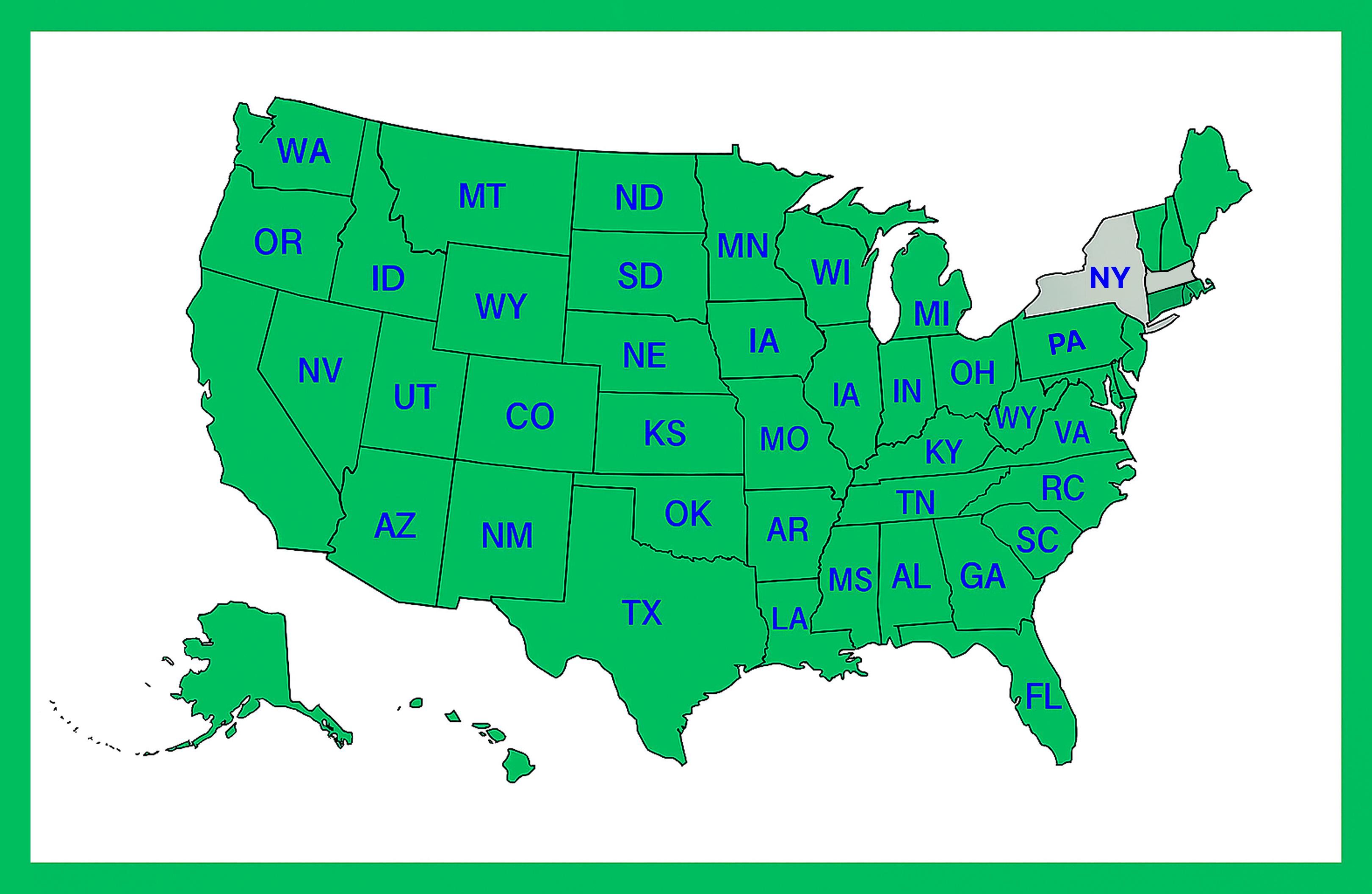

Select your State to get started

Learn About Home Equity

Knowing more about home loans can help you better manage your financial life.

What is a home equity line of credit (HELOC)?

A HELOC is a revolving line of credit that you can use for large expenses or to consolidate higher-interest rate debt.

Learn about how a home equity line of credit works and how it may help you realize your goals from covering unexpected expenses to paying for educational costs and funding home renovations

Connect With Us

1. Down payment assistance and closing cost assistance programs may not be available in your area. Down payment and closing cost assistance amount may be due upon sale, refinance, transfer, repayment of the loan, or if the senior mortgage is assumed during the term of the loan. Some programs require repayment with interest and borrowers should become fully informed prior to closing. Not all applicants will qualify. Minimum credit

scores may apply. Sales price restrictions and income requirements may apply. Homebuyer education may be required. Owner-occupied properties only. Maximum loan amounts may apply.

2. Prequalification is neither preapproval nor a commitment to lend; you must submit additional information for review and approval.

3. Home equity assumptions (discount information plus disclosures and additional assumptions) based on a $100,000 line of credit.

4. Fixed-Rate Loan Option at account opening: You may convert a withdrawal from your home equity line of credit (HELOC) account into a Fixed-Rate Loan Option, resulting in fixed monthly payments at a fixed interest rate. The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is $5,000 and the maximum amount that can be converted is limited to 90% of the maximum line amount. The minimum

loan term is 1 year, and the maximum term will not exceed the account maturity date.

Fixed-Rate Loan Option during loan term: You may convert all or a portion of your outstanding HELOC variable-rate balance to a Fixed-Rate Loan Option, resulting in fixed monthly payments at a fixed interest rate. Theminimum outstanding balance that can be converted into a Fixed-Rate Loan Option is $5,000 from an existing HELOC account. The minimum loan term is 1 year, and the maximum term will not exceed the account maturity

date. No more than three Fixed-Rate Loan Options may be open at one time. Rates for the Fixed-Rate Loan Option are typically higher than variable rates on the HELOC.

Important Disclosures and Information

Connect with us

©Copyright 2026. All Rights Reserved by NEXA Mortgage LLC.